For a great overview of Medicare 101 – The Basics, please click here to watch a wonderful video by the NC SHIIP program.

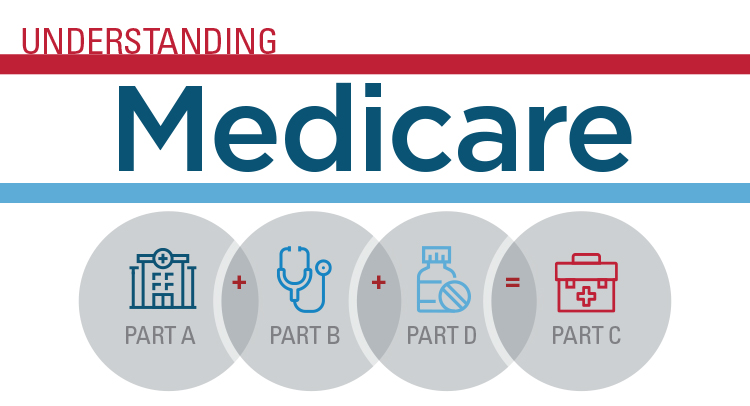

The Senior Health Insurance Information Program, better known as SHIIP is a consumer information division of the NC Department of Insurance that assists people with Medicare, Medicare Part D, Supplement Plans, Medicare Advantage Plans and Long-term Care information. The NC Department of Insurance also tries to help you recognize and prevent Medicare billing error and fraud and abuse. There are 5 parts of Medicare: Part A, Part B, Part D and Part C (Medicare Advantage Plans) and Supplement Plans.

Part A: Hospital Insurance

The Medicare premium for Part A is $0 as long as you qualify (worked 40 quarters or more). For those who do not qualify, the premium is $471 per month. So what does it cover?

- Inpatient Hospitalization

- Post-Hospital Skilled Nursing

- Home Health Care

- Hospice Care

Part B: Medical Insurance

The monthly Part B premium for 2021 is $148.50. Premiums will be higher for those who have an annual income of $85,000 or more, married couples, $170,000 or more. So what does it cover?

- Medical Expense

- Clinical Laboratory Services

- Home Health Care

- Outpatient Hospital Treatment

- Blood

- Note: Once you have paid the $203 deductible, the Part B deductible does not apply to any other services.

Medicare Part C

Medicare Part C or as it is better known, Medicare Advantage Plans, are plans approved by Medicare but sold and serviced by private companies. Options for these plans include a provider network (HMO’s and PPO’s). Some plans include drug coverage but not all. To enroll in an advantage plan you must have both Medicare Part A & B. Once you enroll in a Medicare Advantage Plan, you will not use your red, white and blue Medicare Card as this will replace Original Medicare. Please note that you will continue to pay the Medicare Part B premium, and you might also have to pay an additional monthly premium charged by the Medicare Advantage Plan. Also, if you have an advantage plan, remember to check with your health care providers before making any changes to your Medicare coverage to ensure that they will accept your Medicare Advantage Plan.

Medicare Part D

Medicare Part D is a prescription drug plan benefit that is provided by private companies that sell plans approved by Medicare. All who are approved by Medicare have a seven month window to enroll in a Medicare Part D plan. This is the 3 months before your birthday, the month of your birthday, and the 3 months following your birthday. All people that have Medicare are eligible for a Part D plan regardless of income or assets. Unless you are new to Medicare or have a special enrollment period, you must enroll during open enrollment, which is October 15th through December 7th each year. If you do not enroll in a Medicare Part D plan when you are eligible or if you do not have credible coverage in place, in most cases you will have to pay a penalty for life when you do enroll in a PDP during open enrollment. There is assistance available for those who have limited income and resources. If you qualify, you can get assistance with premiums, deductibles and co-payments for your prescriptions.

Standardized Medical Supplement Plan

Supplement Plans, depending on which one that you choose, can cover the remaining cost from your Medicare Part A & B. These policies are purchased through specific companies and can be bought through insurance agencies. Supplement Plans can cover: Part A coinsurance and Hospital cost, Part B coinsurance or copayment, Parts A & B Blood deductibles, Part A Hospice Care coinsurance or copayment, Skilled Nursing Facility coinsurance, Part A deductible, Part B deductible, Part B Excess and Foreign Travel Emergency.

Disclaimer: The highlighted monetary numbers above are for the year 2021. Please be aware that amounts are subject to change.